will long term capital gains tax change in 2021

Capital gains are the profits from the sale of an asset shares of stock a piece of land a business and generally are considered taxable income. How Can I Avoid Paying Capital Gains Tax.

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Put your money aside for the long run.

. Depending on how long you hold your capital asset determines the amount of tax you will pay. Long-term capital gains tax rates for the 2022 tax year Source. For assets held less than one year short-term gains are taxed at regular income rates which may be as high as 34 based on the taxpayers individual income.

Accordingly long-term capital gains rates are zero 15 or 20. How much these gains are taxed depends a lot on. Historically capital gains tax has sat around 20.

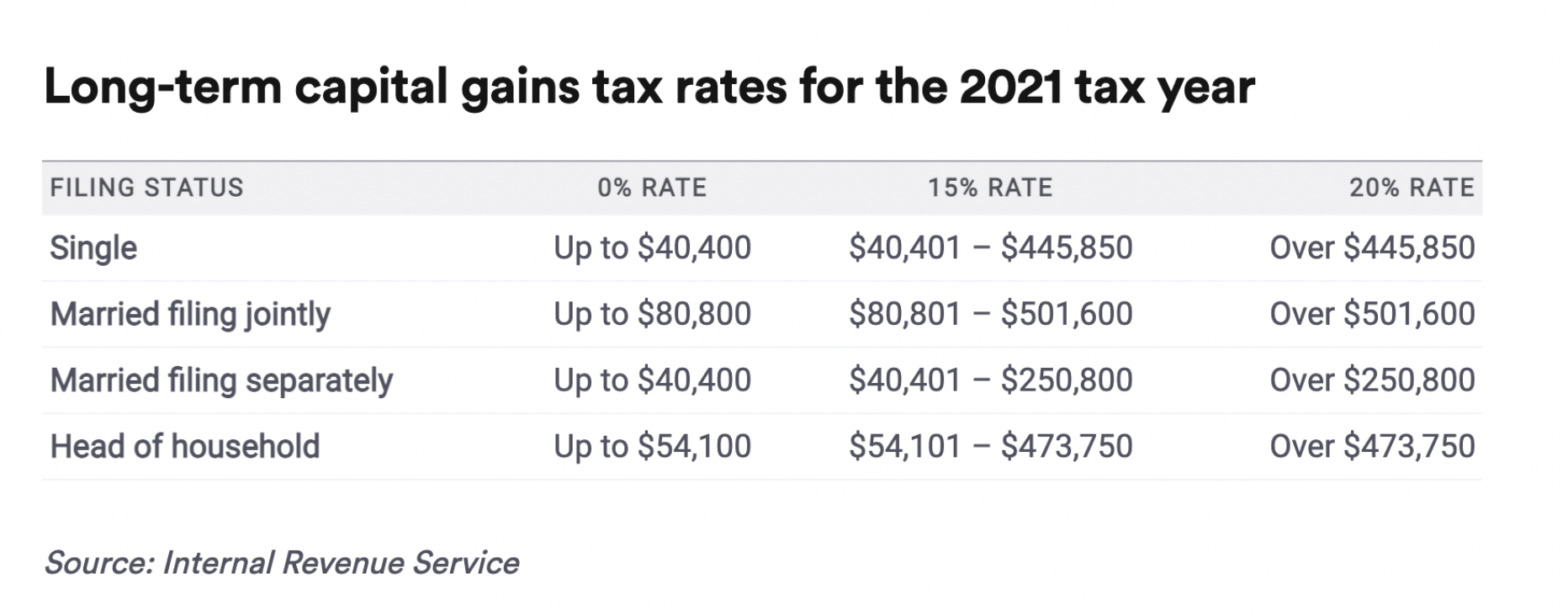

As a business seller if you are in either the low or mid earning bracket any proposed changes will not affect you so proceed with the sale of your business. Long-term gains still get taxed at rates of 0 15 or 20 depending on the. 2021 Longer-Term Capital Gains Tax Rate Income Thresholds The income thresholds for the capital gains tax rates are adjusted each year for inflation.

To see how the thresholds will change from 2021. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. The proposal would increase the maximum stated capital gain rate from 20 to 25.

Currently the capital gains tax rate for wealthy investors sits at 20. Married couples assuming 800 or less 40400 for single investors and married couples are excluded in 2021 the brackets are 0 and 15. News October 21 2021 at 0255 PM Share.

Internal Revenue Service For example in 2021 individual filers wont pay. Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household.

There are short-term capital gains and long-term capital gains and. The proposal is bumping this up to 396. Long Term Care Insurance.

Short-term gains are taxed as ordinary income. It is estimated that 100 will be paid in tax on this allocation in the 2020 to 2021 tax year. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes.

Capital Gains Tax Changes Likely to Stay in Spending Bill. Potential Changes to the Capital Gains Tax Rate 9142021 UPDATE. What Will Capital Gains Tax Be In 2021.

Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change. Short-term capital assets are taxed at your ordinary income tax rate up to 37 for 2022.

After federal capital gains. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Limit on the Deduction and Carryover of Losses If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately or your total.

House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion. The Capital Gains tax-free allowance should be deducted as soon as the capital gain is realized. Federal tax rates are lower for long-term capital gains which is why its generally recommended to hold assets for at least a year to minimize your tax liability.

Running Your Business. Long-term gains still get taxed at rates of 0 15 or 20 depending on the taxpayers income while short-term capital gains on assets held for a year or less are considered ordinary income for tax purposes. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

Here are the 2021 long-term capital gains tax rates. The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling. For 2021 reporting year the federal short-term capital gains rate is the same as your ordinary income tax rate where your tax rate is.

A summary can be found here and the full text here. Remember if you have short-term capital gains they are taxed at the ordinary income tax rates. There is a change on the horizon which can take place as soon as 2022.

The House Ways and Means Committee released their tax proposal on September 13 2021. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021. In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy taxpayers from quickly selling off assets to avoid the.

There are exceptions to this such as when it was 15 from 2004 to 2012. Capital Gains Tax rates of 10 apply to a combined amount less than 37500 the basic rate band for the 2020 to 2021 tax year so your capital gains.

Selling Stock Are There Tax Penalties On Capital Gains The Motley Fool

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Advice News Features Tips Kiplinger

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Capital Gains Tax Understand Long Term Short Term Capital Gains

House Capital Gains Tax Better For The Super Rich Than Biden Plan

Capital Gains Definition 2021 Tax Rates And Examples

The Long And Short Of Capitals Gains Tax

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Roundup 2021 Edition Morningstar

What S Your Tax Rate For Crypto Capital Gains

Latest Income Tax Slab Rates For Fy 2021 22 Ay 2022 23 Budget 2021 Key Highlights Basunivesh

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)